DISCLOSURE OF INFORMATION TO SHAREHOLDERS REGARDING THE SHARE BUYBACK OF THE COMPANY UNDER SIGNIFICANTLY FLUCTUATING MARKET CONDITIONS

11 December 2025

FOREWORD

PT Gema Grahasarana Tbk (“Compay”) plans to carry out a buyback of its shares listed on the Indonesia Stock exchange, referring to the Financial Services Authority Regulation No 13/POJK.4/2023 concerning Policies To Maintain Performance And market Stability Under Significantly Fluctuating Market Conditions, Financial Services Authority Regulation No 29/POJK.4/2023 concerning Shares Buybacks Issued by Public Company and OJK Letter No S-102/D.04/2025 dated September 17,2025 regarding the Policy On The Implementation Of Share Buyback By Public Companies Under Significantly Fluctuating Market Conditions.

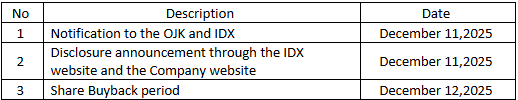

SCHEDULE OF IMPLEMENTATION

The share buyback by the Company will be carried out according to the following schedule:

PROJECTION OF COST OF REPURCHASING OF COMPANY SHARES

The expenses that the Company will incur for the share repurchase implementation are the fees paid to the securities intermediary, which amount to a maximum of 0.15% of each purchase transaction.

In implementing the Share Buyback, the Company will use the Company's internal funds and not from loans or funds from public offerings.

PROJECTION OF TOTAL VALUE OF COMPANY SHARES TO BE REPURCHASED

The Company has allocated a maximum fund of Rp 7,000,000,000.00 (seven billion Rupiah) for the repurchase of the Company’s shares up to the maximum prices as per applicable regulation. Therefore, the total nominal amount of shares to be repurchased by the Company will depend on the market stock price.

In accordance with POJK No. 13/2023, the number of shares to be repurchased in the implementation of share buyback will not exceed 20% (twenty percent) of the total issued and paid-up capital of the Company while still taking into account the provision that the number of free float shares after the implementation of the Share buyback will not be less than 7.5% (seven point five percent) of the issued and paid-up capital of the Company.

PROJECTION OF REDUCED EARNINGS OF THE COMPANY AS RESULT OF THE REPURCHASING OF COMPANY SHARES AND IMPACT TO COMPANY’S FINANCING

The Company anticipates that there will no significant impact on the decrease in revenue due to the implementation of the shares repurchase. Additionally, the impact of the share repurchase on the Company’s financing costs is expected to be minimal.

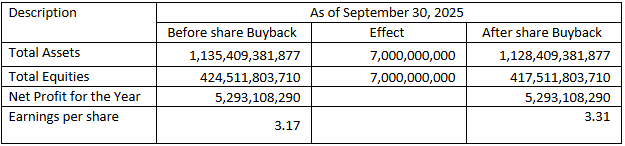

PERFORMANCE OF COMPANY’S EARNING PER SHARE AFTER THE REPURCHASING OF SHARES, TAKING INTO ACCOUNT REDUCED EARNINGS

The following is the proforma earnings per share of the Company bases on the Company’s financial statements for the period ending September 30,2025 taking into account the value of the maximum share buyback of Rp 7,000,000,000.00 (seven biliion Rupiah)

RESTRICTION TO SHARE PRICE FOR THE REPURCHASING OF SHARES

The share repurchase will be conducted at price that is lower than or equal to the price of previous transaction.

LIMITATION TO THE PERIOD OF REPURCHASING OF SHARES

The share buyback will be carried out within of three (3) months following the date of the Disclosure of Information, namely from December 12,2025 to March 12,2026. The Company may terminate the buyback if the following conditions are met:

- The 3 (three) month period has expired;

- Funds disbursed for the buyback have reached IDR 7,000,000,000 (seven billion Rupiah);

- The Company decides to terminate the shares purchase.

If the buyback is terminated due to the conditions in point 3 (three), the Company will provide information regarding the termination of the buyback to the Financial Services Authority (OJK) along with the reasons and announce it to the public no later than 2 (two) business days after the termination.

METHOD IMPLEMENTED IN THE REPURCHASING OF SHARE

The Company’s share repurchase will be conducted through the Indonesia Stock exchange (Bursa Efek Indonesia) and therefore the share purchase transaction of the Company will be executed through one of Exchange Members, namely PT Artha Sekuritas Indonesia.

DISCUSSION AND MANAGEMENT ANALYSIS ON THE IMPACT OF THE REPURCHASING OF SHARE TO THE COMPANY’S FUTURE ACTIVITIES AND GROWTH

The Company believes that the Share Buyback will not have a material negative impact on its business activities and growth. The Share Buyback is expected to stabilize the Company's share price in volatile market conditions, while also providing investors with confidence in the fundamental value of the Company's shares.

Tangerang, December 11, 2025

PT GEMA GRAHASARANA TBK

BOAD OF DIRECTOR